Sorry - this product is no longer available

ORB Trading System and Indicator Set for TradeStation®

Automated trading strategies. Discretionary trading indicators. A quantitative analytic approach to trading stocks, ETFs and futures. The ORB uses a unique system for identifying profitable swing trading opportunities. Own it with rules and source code.

The ORB Trading System and Indicator Set for TradeStation®

Automated trading system with a quantitative analytic approach to trading stocks, ETFs and futures.

Data Sheet

- Trade fully automated with included TradeStation™ strategies

- Trade discretionary using included TradeStation™ indicators

- Excels at trading instruments that track the S&P 500 stock index

- E-mini S&P 500 futures contract trading

- Works with many markets including stocks and ETFs

- Written in 100% EasyLanguage with all source code provided to you

- Easy to customize for different markets

- Includes 5 pre-configured versions that showcase the versatility of the system

The ORB trading system is delivered to you with complete source code and a PDF file containing detailed instructions and explanation of all trading rules. Nothing is kept secret.

FULL MONEY BACK GUARANTEE

We offer a performance based money back guarantee. If the system is not profitable you are entitled to receive a full refund. See Refund Policy below for details.

Unique Features of The ORB Trading System

- Ability to run fully automated

- Includes two custom indicators

- Easy to use - discover and place trades in seconds

- Full source code and disclosure of all trading rules

- Runs in real time in the RadarScreen™

- TradeStation™ strategy, TradeStation™ indicators and TradeStation™ workspace

You can easily customize the behavior of the ORB's internal algorithm by following the instructions in the user manual. This is a great feature for those who wish to experiment with many markets, however it's not necessary as the ORB comes packaged with default settings that make sense for most markets.

In addition to the core system we provide additional versions of the ORB trading system:

- High Profit version for the S&P 500

- Alternative trade setup version for the S&P 500

- Stocks

- ETFs

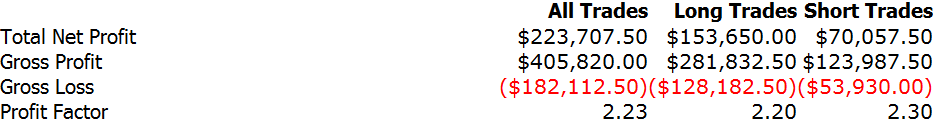

ORB Equity Performance Report

The following performance results are for the default ORB settings trading the E-mini S&P 500 Futures Contract ( The ES ).

Commissions and slippage INCLUDED!

E-mini S&P 500 Futures Contracts (up to 2 per trade) 05/01/2006 - 07/31/20

First trade was taken in early 2006 ( 1/1/2004 on the report below is the start of historical bar back fill ).

Stocks

The ORB trading system can be applied to any market including individual stocks. By using the parameters included with the system, we will also show you how you can tune the ORB system to perform well with the higher volatility of stock markets.

Standard Strategy Features

Various inputs and settings to help customize and optimize each strategy.

- Each strategy is also provided as an indicator which can be used for scanning purposes or displayed within a chart or RadarScreen™.

- Option to use TradeStation™ sound, message and email alerts.

- Includes PDF manual and pre-configured TradeStation™ workspace.

What’s in the Box?

You’ll receive the system via email approximately one business day after purchase. You’ll receive several artifacts of the ORB trading system product:

- PDF file containing a manual that explains the ORB trading system in detail including the trading rules.

- TradeStation™ import file that contains the ORB trading system. This can be imported into TradeStation simply by double clicking on the ELD file. Once imported you’ll be able to run the ORB system.

- Once the evaluation period expires ( See Refund Policy below ), You’ll receive a second email containing the full source code version of the system. You’ll be able to view the source code and see exactly how the EasyLanguage code implements the ORB indicators and strategy.

- A predefined TradeStation™ workspace that has the ORB setup and configured in the RadarScreen™ for stocks and in a charts for the E-mini S&P 500 Futures contract. You’ll be able to start using the ORB immediately.

Refund Policy

The following conditions qualify for a full refund. The evaluation is based on the performance of the “ORB2 fast adx” automated trading strategy in its standard configuration set to trade just one E-mini S&P 500 futures contract (ES) for the time span of 3 months from the time you purchase the system. If this system is not profitable from trades taken during this period of time you qualify for the refund. It’s not necessary for you to trade with real money to qualify. Just email us your list of order executions including time and price before 4 months from time of purchase. If we do not receive this request after 4 months ends you will receive the source code version of the system. You may, at your option by emailing us, waive the remainder of the evaluation period at which time you will receive the source code version immediately.

Continued Support and Updates for a Minimum of 12 Months

We continue to maintain the products you buy from us after your purchase. You’ll get full support and updates for at least one year after purchase. If you have any problems or require any additional information you can contact us for assistance.

Don’t hesitate to contact us questions about any of our products.

ORB Trading System and Indicator Set for TradeStation™

The ORB trading system automatically finds trading opportunities in any market that’s accessible in TradeStation, including Stocks, ETS and Futures. Buy and Sell signals are clearly and precisely identified. The system can be set to automatically execute trades or simply signal you when a trading opportunity exists.

Regular Price: $1299- Now:$799 Available for immediate online delivery from: AutomaticTradingSignals.com