Trade the S&P 500

This systematic approach to trading eliminates all the painful guesswork and hesitation that comes with discretionary trading.

Features of the RD3 Trading System

- Fully Automated Trading with Ninjascript® strategies

- Day Trading

- Swing Trading

- Trade Futures, ETFs and Stocks

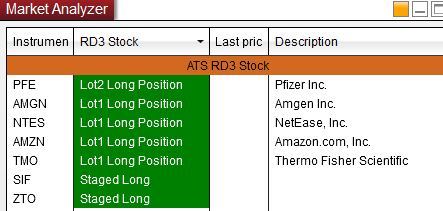

- Integrates with Market Analyzer® to find great trade setups

- Clear and Easy to follow signals with Ninjascript® signaling indicators

- Additional supporting indicators for Charts and Market Analyzer®

- NinjaTrader® Alerts

- In time e-mail and text message alerts for remote notification and order submission for manual trading option assist

- Preconfigured NinjaTrader® workspaces for fast setup

- Chart and Market Analyzer® templates for easy integration into your existing workspaces

- Well documented with quick start guide and 21 page user manual

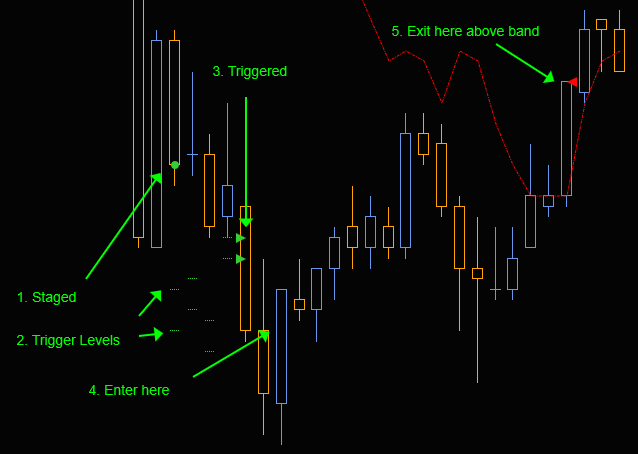

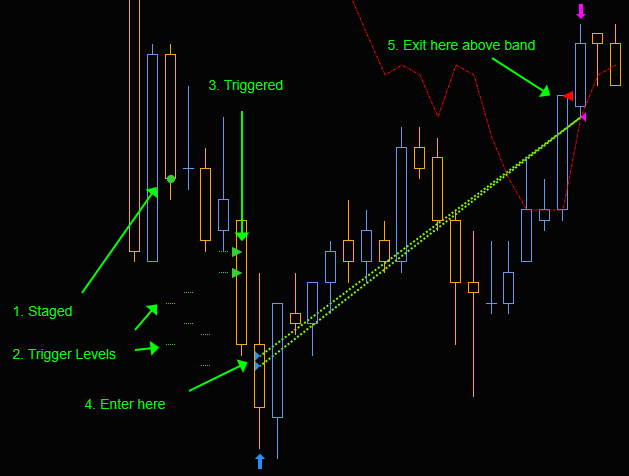

Clear and Easy to follow signals are provided by the RD3 signaling indicator. You’ll quickly know when to enter a trade, in which direction and when to exit. No complicated over-engineered visuals to confuse and distract you from the price action.

Let the AtsRD3 manage the trades for you.

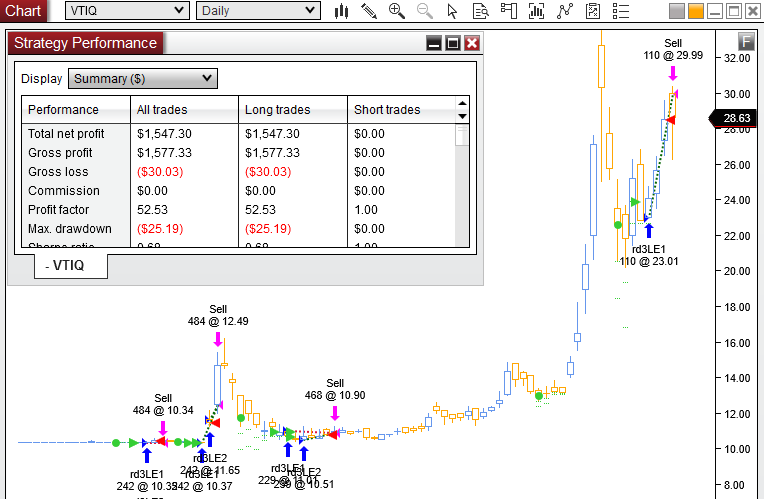

Enjoy the confidence that comes with fully Automated Trading using the RD3 NinjaTrader® strategy. You’ll be able to see the trade setups unfold in real time so you’ll be able to anticipate exactly when the system will place a trade. Or place trades yourself using the same RD3 signaling indicator used by the strategy.

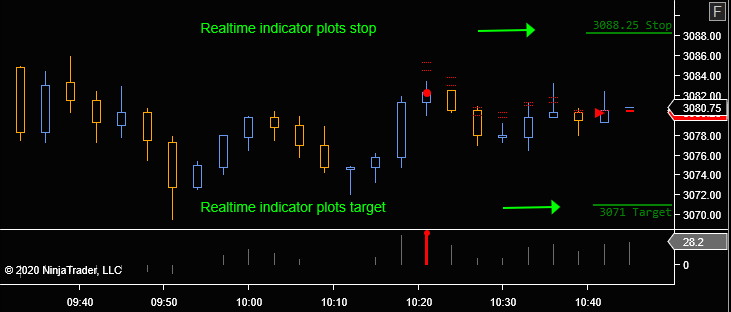

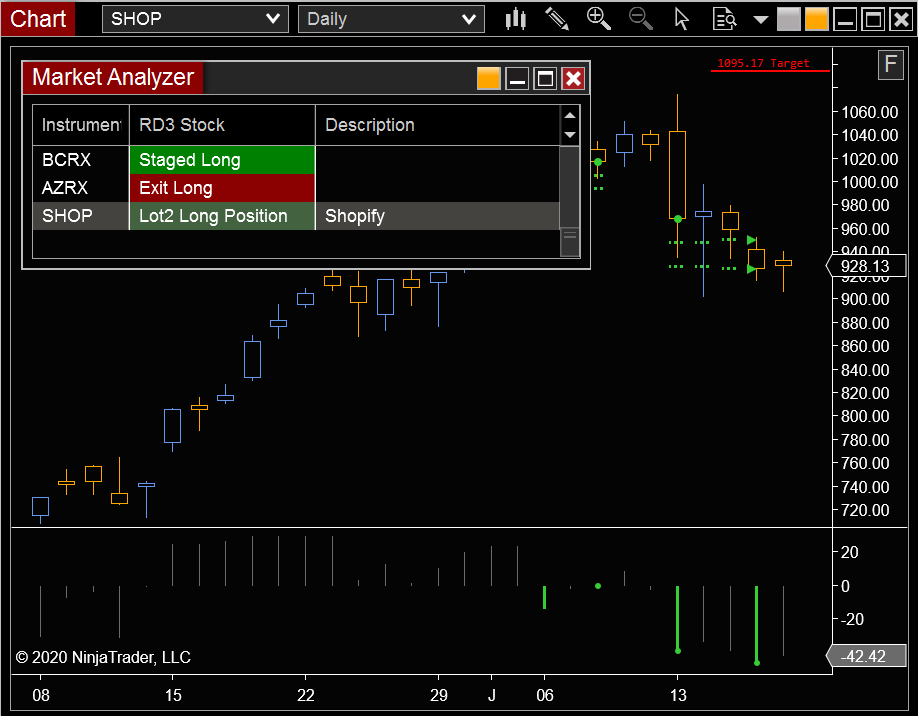

Turn on the target and stop indications for even more discretionary trading direction.

Simple to use right out of the box. Open a chart and insert either the RD3 signaling indicator or the RD3 strategy.

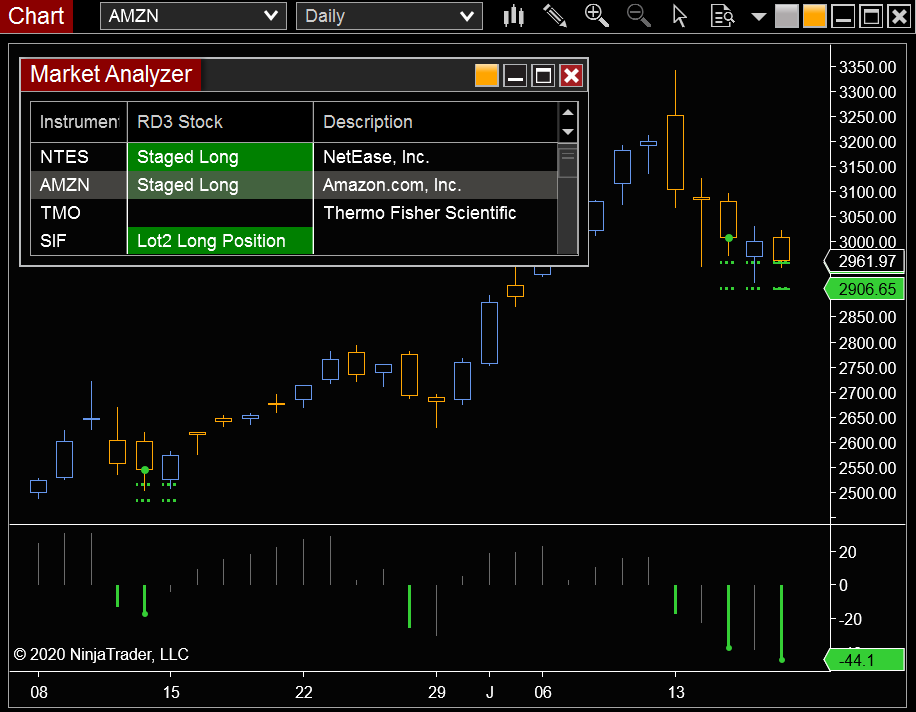

Dig deeper by scanning multiple markets with the provided RD3 Market Analyzer® indicator. The RD3 will find trading opportunities where you did not expect to find them.

Using the RD3 running in the Market Analyzer® you'll be able to quickly identify stocks in your watch list that are meeting the RD3 setup. One click on the Market Analyzer® row and the linked chart loads.

This system can be enabled to trade long or short in any market you want. Disable the shorting side to concentrate on the long or visa versa.

With the all new custom e-mail feature you don’t have to be sitting in front of NinjaTrader® to know when to trade. You’ll get an e-mail complete with the chart and instructions what to do. You can easily shadow trade the signals using any broker in as many accounts you want.

Use the RD3 on futures, stocks and ETFs.

Videos

RD3 Editions (all editions are included in this offer)

Trader – Fully functional. Provides all trade signals and setups. You won’t miss a trade with the Trader Edition.

- RD3 signaling indicator

- RD3 strategy with full automation

- RD3 Market Analyzer® indicator for tracking multiple markets at the same time

- Fully configured workspaces, chart and Market Analyzer® templates

- Runs in Strategy Analyzer® so you can see how well each version works on markets you’re interested in

- User manual explains everything you want to know

Professional - Everything in the Trader edition plus:

- All indicator and strategy trading rules

- Full exposure of additional parameters that control the algo logic

- Strategy Analyzer® optimization support

- 3 additional indicators: RD3 Bands, RD3 Oscillator and RD3 Cross. The logic of these indicators is used internally by the RD3 signaling indicator. Using these you will see the conditions of the trading rules unfold on your screen.

No matter which edition you choose you’ll get all the packaged versions of the RD3 system:

- RD3 Core – most reliable trades for stock indexes

- RD3 HP – signal even more trades for stock indexes without giving up too much reliability

- RD3 Target – an alternative way to exit with target price and stop market orders

- RD3 Stock – setup for most S&P 500 stocks or even any stock

- RD3 240 night swing system

- RD3 day trading system

What’s in the Box?

You’ll receive the system via email approximately one business day after purchase.

The email will go to the one associated with your PayPal account unless you ask for delivery elsewhere. Check your SPAM or JUNK mail folder.

You’ll receive several artifacts of the RD3 trading system product:

- NinjaTrader® import file that contains the RD3 trading system. This can be imported into NinjaTrader® using the File | Utilities | Import NinjaScript utility within NinjaTrader®. Once imported you’ll be able to run the RD3 system.

- PDF file containing a manual that explains the RD3 trading system in detail including the trading rules.

- A predefined NinjaTrader® workspace that has the RD3 setup and configured in a Market Analyzer for stocks and in a charts for the E-mini S&P 500 Futures contract. You’ll be able to start using the RD3 immediately.

Don't have NinjaTrader®?

Try it for free, complete with free realtime data.

HERE is where you can get the FREE NinjaTrader® platform.

Continued Support and Updates for a Minimum of 12 Months

We continue to maintain the products you buy from us after your purchase. You’ll get full support and updates for at least one year after purchase. If you have any problems or require any additional information you can contact us for assistance.

Don’t hesitate to contact us questions about any of our products.

RD3 Trading System and Indicator Set for NinjaTrader®

The RD3 trading system automatically finds trading opportunities in any market that’s accessible in NinjaTrader, including Stocks, ETFs and Futures. Buy and Sell signals are clearly and precisely identified. The system can be set to automatically execute trades or simply signal you when a trading opportunity exists.

Regular Price: $1299- Now:$597Available for immediate online delivery from: AutomaticTradingSignals.com